In the dynamic world of financial technology (FinTech), the role of skilled finance software developers cannot be overstated. These professionals are the backbone of any successful FinTech venture, responsible for crafting robust, secure, and innovative solutions. In this article, we’ll delve into what FinTech entrepreneurs should anticipate when engaging with a finance software development company. From expertise to collaboration, we’ll cover the key aspects that are crucial for a thriving FinTech business.

Expertise in Financial Domain Knowledge

A. Understanding the FinTech Landscape

A reputable finance software development company should possess a deep understanding of the FinTech industry. This includes familiarity with various financial instruments, compliance requirements, and the nuances of payment processing. Their expertise should extend to areas such as blockchain, robo-advisors, peer-to-peer lending, and more.

B. Regulatory Compliance and Security

In the financial sector, compliance with industry regulations is paramount. Finance software developers should be well-versed in the legal frameworks governing financial transactions and data protection. Additionally, they should be adept at implementing robust security measures to safeguard sensitive information from cyber threats.

Cutting-Edge Technological Proficiency

A. Full-Stack Development Capabilities

Finance software developers should possess comprehensive proficiency in a wide range of programming languages, frameworks, and technologies. This includes front-end development for user interfaces, back-end development for server-side operations, database management, and integration of third-party APIs.

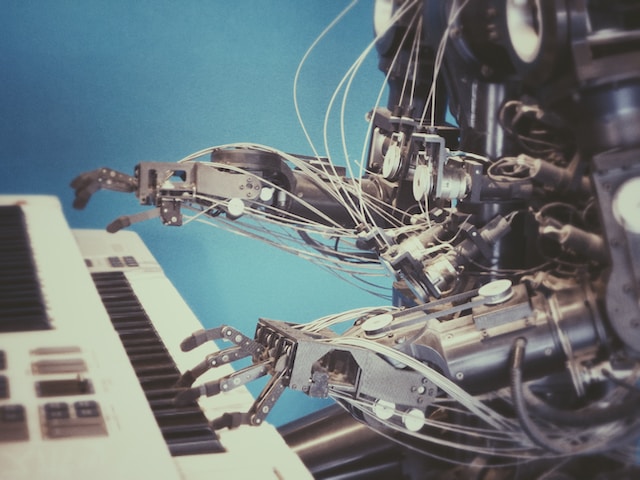

B. Embracing Emerging Technologies

The FinTech landscape is constantly evolving, with emerging technologies like blockchain, artificial intelligence, and machine learning playing pivotal roles. A proficient finance software development company should have a finger on the pulse of these advancements, ready to leverage them to create innovative solutions for your FinTech venture.

Read more: How to start a FinTech Company

Customized Solutions Tailored to Business Needs

A. Personalized Development Approach

Each FinTech venture has its unique set of requirements and objectives. A proficient finance software development company should adopt a tailored approach, working closely with the entrepreneur to understand their vision, goals, and target audience. This ensures that the end product aligns perfectly with the business’s strategic objectives.

B. Scalability and Flexibility

As a FinTech entrepreneur, it’s crucial to anticipate future growth and the potential need for scalability. The finance software development company should be equipped to build solutions that can adapt and expand as the business evolves. This ensures that the technology remains an asset rather than a limitation.

Strong Communication and Collaboration Skills

A. Transparent Project Management

Clear and open communication is the cornerstone of a successful collaboration between FinTech entrepreneurs and finance software developers. The development company should have effective project management processes in place, providing regular updates, milestones, and addressing any concerns in a timely manner.

B. Collaboration and Feedback Loops

A productive working relationship involves a two-way street of feedback and collaboration. The finance software development company should be receptive to the entrepreneur’s input, incorporating their vision into the development process. Additionally, they should be proactive in offering suggestions and solutions based on their expertise.

Support and Maintenance Post-Deployment

A. Continuous Improvement and Updates

Launching a FinTech solution is just the beginning. A reliable finance software development company should be committed to providing ongoing support and maintenance. This includes regular updates to address any emerging security concerns, technological advancements, and evolving user needs.

B. Scalable Infrastructure for Growth

As the FinTech venture gains traction, the finance software development company should be prepared to scale the infrastructure to accommodate increased user volumes and transaction loads. This ensures that the technology can seamlessly support the business’s growth trajectory.

Conclusion

Choosing the right finance software development company is a critical step in the journey of starting a FinTech company. By prioritizing expertise in financial domain knowledge, technological proficiency, customized solutions, effective communication, and post-deployment support, entrepreneurs can set their venture on a path to success. With the right development partner, a FinTech business can not only thrive in today’s competitive landscape but also be poised for sustained growth in the dynamic world of financial technology.