In a world where financial stability and proof of income are essential, pay stubs play a crucial role. Whether you’re applying for a loan, renting an apartment, or simply tracking your earnings, having accurate pay stubs is a must. However, not everyone has access to professional payroll services or pay stub generators. That’s where the “Zero to Pay Stub Hero” DIY approach comes in.

In this guide, we’ll walk you through the steps to create your pay stubs for free, ensuring they’re not only accurate but also meet the standards required for various financial and personal needs.

Understanding the Importance of Pay Stubs

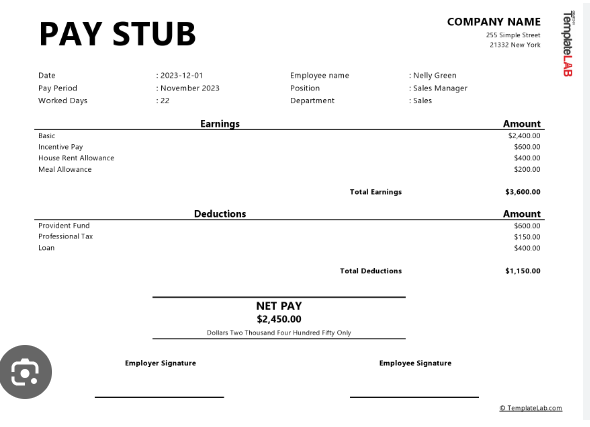

Before we dive into the DIY approach, it’s crucial to understand why pay stubs matter. A pay stub is a document that outlines your earnings, deductions, and other financial details related to your employment.

Here’s why pay stubs are essential:

- Proof of Income: Pay stubs serve as concrete proof of your income, which is often required when applying for loans, renting apartments, or even applying for certain jobs.

- Budgeting: Having a clear breakdown of your income and deductions helps you manage your finances better and plan your budget effectively.

- Tax Compliance: Pay stubs provide information on taxes withheld, aiding in accurate tax filing and preventing potential issues with the IRS.

- Legal Requirements: Some states and employers have legal requirements for providing pay stubs to employees. Knowing your rights is essential.

Gathering the Necessary Information

To create your pay stubs, you’ll need to gather some essential information and documents.

Here’s what you’ll need:

- Personal Information: Start by collecting your details, including your full name, address, and Social Security Number (SSN).

- Employment Details: Gather information about your employer, such as the company name, address, and contact information.

- Payroll Records: Collect your recent pay statements, as these will serve as a reference for creating your pay stubs.

- Tax Information: Ensure you have accurate information about your federal and state tax withholding, including your filing status.

Choosing the Right DIY Tools

Creating pay stubs from scratch can be a daunting task, but thanks to various online resources, it’s now more accessible than ever.

Here are some free DIY tools and resources you can use:

- Pay Stub Templates: Many websites offer free pay stub templates that you can customize to suit your needs. Look for user-friendly templates that allow you to input your information accurately.

- Online Pay Stub Generators: Several online pay stub generators are designed to help you create professional-looking pay stubs quickly. These tools often come with step-by-step instructions, making the process easier.

- Spreadsheet Software: If you’re comfortable with spreadsheet software like Microsoft Excel or Google Sheets, you can create your pay stubs manually. There are templates available online to help you get started.

Creating Your Pay Stubs

Now that you have the necessary information and tools let’s walk through the process of creating your pay stubs:

- Select a Template: If you’re using a pay stub template or online generator, choose one that matches your needs. Ensure it includes fields for your personal information, employment details, income, deductions, and taxes.

- Enter Your Information: Carefully input all the required information into the template. Double-check for accuracy, as errors can lead to financial complications later.

- Calculate Taxes: If your template doesn’t automatically calculate taxes, use the tax information you gathered to determine the correct amounts for federal and state taxes. Be sure to follow the latest tax regulations.

- Review and Save: Once you’ve entered all the details, review your pay stub to ensure accuracy. Save it as a PDF or print a hard copy for your records.

Pay Stub Best Practices

To ensure your DIY pay stubs meet industry standards and avoid potential issues, follow these best practices:

- Accuracy is Key: Double-check all the information on your pay stub to ensure it’s accurate and up-to-date.

- Stay Informed: Keep yourself informed about tax laws and regulations in your state to ensure your pay stubs comply with current requirements.

- Save Copies: Maintain a record of your pay stubs for at least three years, as they may be needed for future reference or verification.

- Use Legible Fonts: When customizing your pay stubs, choose legible fonts and formatting to ensure clarity and professionalism.

When to Seek Professional Help

While the DIY approach is excellent for many individuals, there are situations where professional assistance is advisable:

- Self-Employment: If you’re self-employed, handling pay stubs can be more complex due to various income sources and tax considerations. Consult a tax professional in such cases.

- Legal Matters: If you encounter legal issues related to your employment or income, consult an attorney who specializes in employment law.

- Complex Tax Situations: If your tax situation is intricate, such as owing back taxes or dealing with multiple income sources, seek advice from a tax expert.

Conclusion

Becoming a “Pay Stub” doesn’t require fancy software or expensive services. With the right information and free DIY tools, you can create accurate and professional pay stubs that meet your financial and personal needs.

Read Similar Articles:

How to Get Dollar General (DG) Pay Stubs?

How to Get a TruBridge Pay Stubs?

How to Get a Paystubs From Family Dollar?

How to get Pay Stubs from the 711 Paystub Portal?