As digital payments continue to grow, more and more companies are searching for solutions for processing payments that are affordable. Actually, just 19% of consumers still like making purchases using cash.

Even while the majority of payment service providers cater to a wide range of industries, there are always those industries about which they are a little more cautious. These frequently come from high-risk sectors where there is a higher chance of fraud or chargebacks by nature.

The “high-risk” classification of your company may make it difficult for you to select the best payment processor. However, who decides whether a company is high-risk? And what elements influence the risk? We’ll go over all of this and more in this post to help you be more ready to choose the best payment processing partner for your company’s requirements.

A High-Risk Merchant Account: What Is It?

To accept debit and credit card payments, businesses classified as “high-risk” must have a high-risk merchant account. A business that is considered high-risk is one that has an increased probability of fraud or chargebacks, along with certain additional features.

Nevertheless, in the payments industry, there is no central body or structure that establishes the risk factors related to a company. Rather, each payment processor and bank has its own set of guidelines.

Certain payment solution providers may explicitly declare that specific industries are not their focus. Others will usually look for specific facts about a company in order to determine risk; based on this information, their application may be approved or denied. In the end, everything comes down to the internal standards and attitude toward risk management of a payment processor.

What Elements Make Up a High-Risk Merchant?

Companies in specific industries may be labeled as high-risk by default since they inherently involve more hazards. A few instances of high-risk sectors are as follows:

Vaping, e-cigarettes, and CBD (Cannabidiol)

Tasers and stun guns

repairing credit

Product/service Multilevel Marketing (MLM) for adults

Pawn stores

Nutraceuticals and supplements

technical assistance

Services for Search Engine Optimization (SEO)

Apart from this, a company may be classified as “high-risk” due to a number of additional characteristics, including:

If you are a newcomer and have never processed payments before, certain processors may classify you as “high-risk.”

Other important concerns include bad credit histories or low credit ratings due to loan defaults, etc. You may perceive more risk if a processor has already placed you on the MATCH list.

The same holds true for companies with contentious product lines or those who do business in areas with murky legal issues.

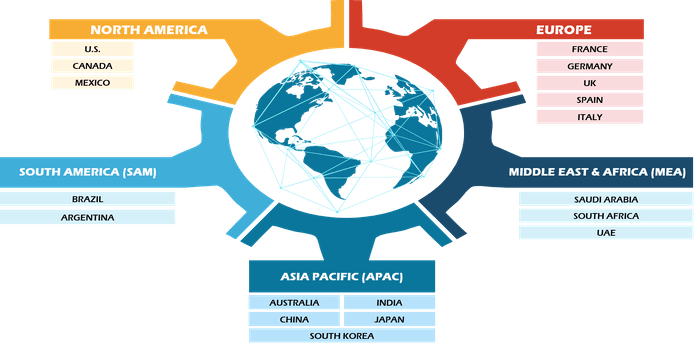

Companies with an excessive reliance on foreign sales may also be rated as high-risk. This is a result of the foreign economy’s comparatively unstable dynamics.

“High-risk” industries are also those that are subject to extensive government or legal regulation.

What Distinguishes High-Risk Accounts for Payment Processors from Regular Accounts?

Having your firm classified as high-risk can be very intimidating. Your application could be simply rejected by a processor. On the other hand, a payment processor may decide to impose some restrictions in order to mitigate your inherent business risk.

A payment processing company can reduce its risk in a number of ways. These are also the main ways that conventional and high-risk merchant accounts differ from one another.

Protracted application procedure

In order to assess your risk profile and look into previous financial trends, a merchant services provider may request extensive information from you when you apply for a high-risk merchant account. Payment processing providers typically run checks on partnerships, your company’s processing history, and even your personal credit history (to check for bad credit, etc.).

more processing fees for payments

Payment processing fees for most small businesses could be 0.3% more than the interchange rate. However, this might increase to 1.5% plus the interchange rate for a merchant account with a high level of risk. Interchange fees might differ from business to business, but generally speaking, increased risk entails higher fees.